How Can I Check My Bvn

BVN (Bank Verification Number) is a unique 11-digit number issued by the Nigerian Inter-Bank Settlement System (NIBSS) to all bank account holders in Nigeria. It is a mandatory requirement for all financial transactions in Nigeria, including opening a bank account, making withdrawals, and transferring funds.

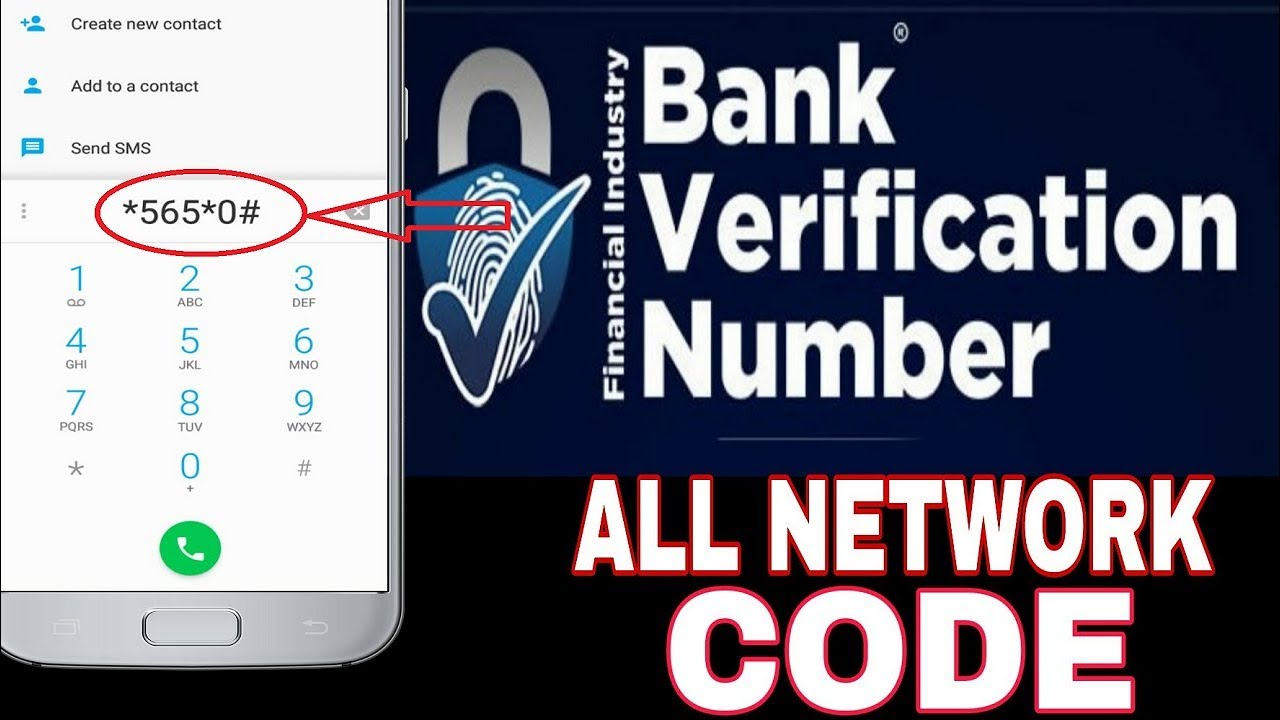

There are several ways to check your BVN. One way is to dial 5650# on your mobile phone. You will receive a message containing your BVN. Another way to check your BVN is to visit your bank branch with a valid ID card. The bank staff will be able to provide you with your BVN.

It is important to keep your BVN confidential and avoid sharing it with anyone. This is because it can be used to access your bank account and personal information.

How can I check my BVN?

BVN (Bank Verification Number) is a unique 11-digit number issued by the Nigerian Inter-Bank Settlement System (NIBSS) to all bank account holders in Nigeria. It is a mandatory requirement for all financial transactions in Nigeria, including opening a bank account, making withdrawals, and transferring funds.

- Dial 5650#

- Visit your bank branch

- Use the NIBSS BVN checker

- Contact your bank's customer care

- Check your bank statement

- Use a BVN lookup service

- Check your credit report

- Use a mobile banking app

It is important to keep your BVN confidential and avoid sharing it with anyone. This is because it can be used to access your bank account and personal information.

Dial 5650#

Dialing 5650# is one of the easiest and most convenient ways to check your BVN. This USSD code is provided by the Nigerian Inter-Bank Settlement System (NIBSS) and works on all mobile networks in Nigeria.

- Simple and easy to use

Dialing 5650# is a simple and straightforward process that can be completed in a few seconds. - Free of charge

There is no charge for dialing 5650# to check your BVN. - Available 24/7

You can check your BVN using 5650# at any time of day or night. - No internet connection required

You do not need an internet connection to check your BVN using 5650#.

Overall, dialing 5650# is the most convenient way to check your BVN. It is simple, free, available 24/7, and does not require an internet connection.

Visit your bank branch

Visiting your bank branch is another option to check your BVN. This method is more traditional but may be necessary if you do not have access to a mobile phone or the internet. However, it is important to note that you may have to wait in line and provide identification.

- In-person assistance

Visiting your bank branch allows you to speak to a bank representative in person. This can be helpful if you have any questions about your BVN or need assistance with other banking services. - Verification of identity

When you visit your bank branch to check your BVN, you will be required to provide identification. This is to ensure that you are the rightful owner of the account and to prevent fraud. - Additional services

In addition to checking your BVN, you can also perform other banking transactions at your bank branch, such as withdrawing or depositing money, transferring funds, or opening a new account.

Overall, visiting your bank branch to check your BVN is a reliable and secure option. However, it is important to be aware of the potential wait times and the need to provide identification.

Use the NIBSS BVN checker

The NIBSS BVN checker is a tool provided by the Nigeria Inter-Bank Settlement System (NIBSS) that allows you to check your BVN online. It is a simple and convenient way to check your BVN without having to visit your bank branch or dial a USSD code.

To use the NIBSS BVN checker, you will need to provide your full name, date of birth, and registered mobile phone number. Once you have entered this information, the NIBSS BVN checker will send you a one-time password (OTP) to your mobile phone. You will need to enter the OTP to verify your identity and access your BVN.

The NIBSS BVN checker is a secure and reliable way to check your BVN. It is also free to use. However, it is important to note that you will need to have an internet connection to use the NIBSS BVN checker.

Overall, the NIBSS BVN checker is a valuable tool for checking your BVN. It is simple, convenient, and secure to use.Contact your bank's customer care

If you are unable to check your BVN using the methods described above, you can contact your bank's customer care. A customer care representative will be able to help you check your BVN and answer any questions you may have.

- Dedicated support

Bank customer care is specifically designed to assist customers with their banking needs, including checking their BVN. They are trained to handle a wide range of inquiries and provide prompt support.

- Personalized assistance

By contacting customer care, you can receive personalized assistance tailored to your specific situation. They can guide you through the process of checking your BVN and address any concerns you may have.

- Additional information

In addition to checking your BVN, customer care representatives can provide you with other relevant information, such as account balance inquiries, transaction history, and assistance with other banking services.

- Convenience

Most banks offer multiple channels for contacting customer care, including phone, email, and live chat. This allows you to choose the most convenient method of communication based on your preference and availability.

Overall, contacting your bank's customer care is a reliable and convenient option for checking your BVN. It provides access to dedicated support, personalized assistance, and additional banking information.

Check your bank statement

Checking your bank statement can be a way to find your BVN. Your BVN is typically printed on your bank statement, along with other important information such as your account number, balance, and transaction history.

- Relevance to BVN

Your BVN is linked to your bank account, and it is used to identify you when you conduct financial transactions. By checking your bank statement, you can easily locate your BVN, which can be useful for various purposes, such as resetting your online banking password or linking your account to other financial services.

- Timing

The timing of when your BVN is printed on your bank statement may vary depending on your bank's policies. Some banks print the BVN on every statement, while others may only include it on statements issued at specific intervals, such as monthly or quarterly.

- Statement availability

The availability of your bank statement can influence your ability to check your BVN using this method. If you receive your statements electronically, you can access them online or through your bank's mobile app. However, if you receive paper statements, you will need to wait for the physical statement to arrive by mail.

- Additional information

In addition to finding your BVN, checking your bank statement can provide you with valuable information about your account activity. You can review your transactions, monitor your spending, and identify any unauthorized or fraudulent activities.

Overall, checking your bank statement can be a convenient way to find your BVN. It is important to be aware of your bank's policies regarding the timing and availability of statements, and to take advantage of the additional information that your bank statement provides.

Use a BVN lookup service

BVN lookup services are platforms that allow you to find your BVN using your personal information, such as your name, date of birth, and registered mobile phone number. These services are typically operated by third-party companies that specialize in providing financial information.

- Convenience

BVN lookup services offer a convenient way to check your BVN without having to visit your bank branch or contact customer care. You can use these services online or through their mobile apps, and you can access your BVN anytime, anywhere.

- Time-saving

Using a BVN lookup service can save you time compared to other methods of checking your BVN. With these services, you can get your BVN in minutes, without having to wait in line or deal with paperwork.

- Additional services

Some BVN lookup services offer additional services, such as credit report checks, loan applications, and investment advice. By using these services, you can access a range of financial services in one place.

- Security concerns

It is important to be aware of the security risks associated with using BVN lookup services. These services require you to provide personal information, and it is important to ensure that the service you are using is reputable and secure.

Overall, using a BVN lookup service can be a convenient and time-saving way to check your BVN. However, it is important to be aware of the security risks involved and to choose a reputable service.

Check your credit report

Your credit report is a detailed record of your borrowing and repayment history. It includes information about your credit accounts, such as credit cards, loans, and mortgages. Your credit report also includes your BVN.

Checking your credit report is an important part of managing your finances. It allows you to see your credit score, which is a number that lenders use to assess your creditworthiness. A high credit score can help you qualify for lower interest rates on loans and other forms of credit. A low credit score can make it difficult to qualify for credit, or you may only qualify for higher interest rates.

There are several ways to check your credit report. You can order a free copy of your credit report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. You can also check your credit report online or through a mobile app.

If you find any errors on your credit report, you should dispute them with the credit bureau. You can do this online, by mail, or by phone.

Checking your credit report regularly is a good way to protect your financial health. It allows you to monitor your credit score and identify any potential problems.

Use a mobile banking app

Mobile banking apps have become increasingly popular in recent years as a convenient and secure way to manage your finances. With a mobile banking app, you can check your account balance, transfer funds, pay bills, and more. Many mobile banking apps also allow you to check your BVN.

- Convenience

Checking your BVN using a mobile banking app is convenient and easy to do. You can check your BVN anytime, anywhere, as long as you have an internet connection. - Security

Mobile banking apps are secure and use the latest security measures to protect your personal information. You can be confident that your BVN is safe when you check it using a mobile banking app. - Additional features

In addition to checking your BVN, many mobile banking apps offer a range of other features, such as the ability to view your transaction history, set up alerts, and manage your investments. - Compatibility

Mobile banking apps are compatible with most smartphones and tablets. You can download the app from your device's app store and start using it right away.

If you are looking for a convenient and secure way to check your BVN, using a mobile banking app is a great option. Mobile banking apps are easy to use, offer a range of features, and are compatible with most devices.

Frequently Asked Questions about Checking BVN

Checking your Bank Verification Number (BVN) is a crucial step for various financial transactions in Nigeria. To provide clarity and address common concerns, here are answers to frequently asked questions about checking your BVN:

Question 1: What is a BVN?

Answer: A BVN is a unique 11-digit number assigned by the Nigerian Inter-Bank Settlement System (NIBSS) to all bank account holders in Nigeria. It is designed to enhance the security and efficiency of financial transactions.

Question 2: Why is it important to check my BVN?

Answer: Checking your BVN allows you to verify its accuracy and ensure that it is linked to your correct bank account. This is particularly important for preventing fraudulent activities and ensuring the smooth processing of financial transactions.

Question 3: How can I check my BVN?

Answer: There are several methods to check your BVN, including: dialing 5650# on your mobile phone, visiting your bank branch, using the NIBSS BVN checker, and checking your bank statement.

Question 4: Can I check my BVN online?

Answer: Yes, you can check your BVN online using the NIBSS BVN checker or through your bank's mobile banking app.

Question 5: What should I do if I have forgotten my BVN?

Answer: If you have forgotten your BVN, you can contact your bank's customer care for assistance. They will guide you through the process of retrieving your BVN.

Question 6: Is it safe to share my BVN with others?

Answer: It is generally not advisable to share your BVN with others. The BVN is a sensitive piece of information that should be kept confidential to prevent unauthorized access to your bank account.

Remember, checking your BVN regularly is essential for maintaining the security and integrity of your financial transactions. By following the methods outlined above, you can easily and conveniently verify your BVN and ensure its accuracy.

Moving forward, the next section will delve into the benefits of checking your BVN, exploring how it can contribute to your financial well-being.

Tips for Checking Your BVN

Verifying your Bank Verification Number (BVN) is a crucial step to ensure the security and accuracy of your financial transactions. Here are some valuable tips to help you check your BVN effectively:

Tip 1: Dial 5650#

Dialing 5650# on your mobile phone is the most convenient method to check your BVN. This USSD code, provided by the Nigerian Inter-Bank Settlement System (NIBSS), allows you to retrieve your BVN instantly.

Tip 2: Visit Your Bank Branch

Visiting your bank branch is a reliable option to check your BVN. You will need to provide valid identification, and a bank representative will assist you in retrieving your BVN.

Tip 3: Check Your Bank Statement

Your BVN is typically included on your bank statement. Check your recent statements to locate your BVN, ensuring you have the most updated information.

Tip 4: Use the NIBSS BVN Checker

The NIBSS BVN checker is an online tool provided by the Nigerian Inter-Bank Settlement System. By entering your personal information, you can retrieve your BVN securely and conveniently.

Tip 5: Contact Your Bank's Customer Care

If you encounter difficulties checking your BVN using other methods, contact your bank's customer care. They will guide you through the process and provide assistance in retrieving your BVN.

Summary

Checking your BVN is a vital step for secure and efficient financial transactions. By following these tips, you can easily verify your BVN and ensure its accuracy. Remember to keep your BVN confidential to prevent unauthorized access to your bank account.

Maintaining the security of your BVN is crucial for protecting your financial well-being. By being vigilant and following these tips, you can safeguard your financial transactions and enjoy peace of mind.

Conclusion

Verifying your Bank Verification Number (BVN) is a crucial aspect of financial security and efficiency in Nigeria. This article has explored various methods for checking your BVN, emphasizing the importance of accuracy and confidentiality. By following the tips and utilizing the resources provided, you can effectively manage your BVN and ensure the integrity of your financial transactions.

Remember, safeguarding your BVN is essential for protecting your financial well-being. Stay vigilant, keep your BVN confidential, and make use of the available channels to check and update your information as needed. By doing so, you contribute to a secure and robust financial system for yourself and the nation as a whole.

How Old Is Jessica Marie Garcia

Ryan Hurst Weight Loss

Paige Lorenze Nose Job