Code To Check My Bvn

"Code to check my BVN" refers to a unique identifier assigned to individuals by the Nigerian government to verify their identity and facilitate financial transactions.

Possessing a BVN is essential for accessing various financial services in Nigeria, including opening bank accounts, obtaining loans, and making online payments. The code helps prevent fraud and identity theft, ensuring the security of financial transactions.

To check your BVN, you can use the following methods:

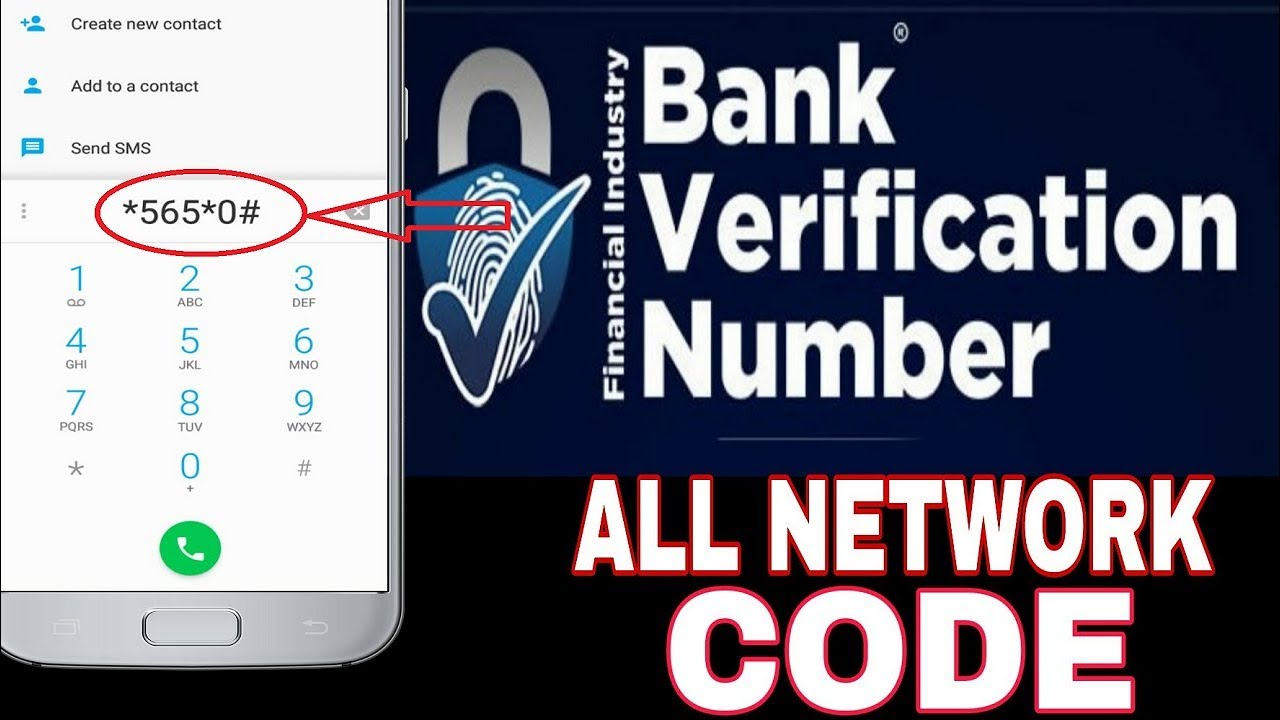

- Dial 5650# on your mobile phone linked to your bank account.

- Visit your bank branch with a valid means of identification.

- Use the BVN Lookup service on the Nigeria Inter-Bank Settlement System (NIBSS) website.

It is crucial to keep your BVN confidential and avoid sharing it with unauthorized individuals. By protecting your BVN, you safeguard your financial information and prevent unauthorized access to your accounts.

Code to Check My BVN

The "code to check my BVN" plays a vital role in safeguarding financial transactions and ensuring the security of financial information. Here are eight key aspects related to this code:

- Unique identifier: Each BVN is unique to an individual, ensuring their distinct identity.

- Financial transactions: The code enables access to various financial services, such as bank accounts and loans.

- Fraud prevention: BVN helps prevent fraudulent activities and identity theft.

- Security: By keeping the code confidential, individuals protect their financial information.

- Verification: The code verifies an individual's identity during financial transactions.

- Online access: BVN can be checked online through the NIBSS website.

- Bank branches: Individuals can also visit their bank branches to check their BVN.

- Mobile banking: Checking BVN is possible via mobile banking by dialing 5650#.

These key aspects highlight the importance of the "code to check my BVN" in promoting financial inclusion, ensuring the safety of financial transactions, and preventing fraudulent activities. By understanding these aspects, individuals can effectively manage their financial information and protect themselves against financial crimes.

Unique identifier

This aspect forms the core of the "code to check my BVN," as it establishes the unique identification of individuals. The BVN serves as a single, unifying identifier across various financial institutions, ensuring that each individual has a distinct digital footprint within the financial system.

- Distinct identity: The BVN eliminates the use of multiple identifiers for a single individual, simplifying financial processes and enhancing accuracy.

- Financial inclusion: By providing a unique identity, the BVN promotes financial inclusion, allowing individuals to access a broader range of financial services.

- Fraud prevention: The unique identification aspect of the BVN helps prevent fraudulent activities by ensuring that individuals cannot impersonate others or create multiple identities.

- Data integrity: The BVN contributes to the integrity of financial data by ensuring that information is linked to a single, verifiable identity.

In summary, the unique identifier aspect of the "code to check my BVN" plays a crucial role in establishing a distinct identity for individuals within the financial system, preventing fraud, promoting financial inclusion, and ensuring data integrity.

Financial transactions

The connection between "financial transactions" and the "code to check my BVN" is fundamental to understanding the role of BVN in the Nigerian financial system. The BVN serves as a gateway to accessing a wide range of financial services, including bank accounts, loans, and other financial products.

By possessing a BVN, individuals can open bank accounts, apply for loans, make online payments, and conduct other financial transactions securely and conveniently. The BVN acts as a unique identifier that links an individual's identity to their financial information, enabling financial institutions to verify their identity and assess their creditworthiness.

For instance, when an individual applies for a loan, the lender will typically request their BVN to access their credit history and verify their identity. This helps the lender make informed decisions regarding the loan application and ensures that the loan is disbursed to the rightful individual.

In summary, the "code to check my BVN" is inextricably linked to financial transactions, as it serves as a key identifier that facilitates access to various financial services. By providing a secure and reliable way to verify an individual's identity, the BVN plays a crucial role in promoting financial inclusion and ensuring the integrity of financial transactions in Nigeria.

Fraud prevention

The "code to check my BVN" serves as a powerful tool in preventing fraudulent activities and identity theft within the Nigerian financial system. By establishing a unique identifier for each individual, the BVN makes it more difficult for fraudsters to impersonate others or create fake identities for illicit purposes.

The BVN plays a critical role in verifying an individual's identity during financial transactions. When an individual provides their BVN during a transaction, financial institutions can cross-check the information against their records to ensure that the person conducting the transaction is the rightful account holder. This process helps prevent unauthorized access to financial accounts and reduces the risk of fraudulent activities.

Furthermore, the BVN helps prevent identity theft by providing a secure and reliable way to verify an individual's identity. By linking an individual's BVN to their personal information, financial institutions can be more confident that the person they are dealing with is who they claim to be. This reduces the risk of identity theft and protects individuals from financial losses and other related crimes.

In summary, the "code to check my BVN" is a crucial component in the fight against fraud and identity theft in Nigeria. By providing a unique identifier and a secure method to verify an individual's identity, the BVN helps protect individuals' financial information and safeguards the integrity of the financial system.

Security

The connection between "Security: By keeping the code confidential, individuals protect their financial information" and "code to check my BVN" lies in the crucial role that the BVN plays in safeguarding financial information and preventing unauthorized access to financial accounts.

The BVN serves as a unique identifier that is linked to an individual's personal information, including their bank accounts and other financial data. By keeping their BVN confidential and avoiding sharing it with unauthorized individuals, individuals can protect their financial information from falling into the wrong hands.

For instance, if an individual's BVN is compromised, fraudsters may gain access to their financial accounts, make unauthorized transactions, and even steal their funds. Therefore, it is essential for individuals to keep their BVN confidential and to be cautious of sharing it with others.

Financial institutions have implemented various security measures to protect individuals' financial information, including strong encryption and fraud detection systems. However, it is equally important for individuals to take responsibility for protecting their own financial data by keeping their BVN confidential.

Verification

The "code to check my BVN" is intricately connected to the verification of an individual's identity during financial transactions. The BVN serves as a unique identifier that is linked to an individual's personal information, including their bank accounts and other financial data. By providing a secure and reliable way to verify an individual's identity, the BVN plays a crucial role in preventing fraud and ensuring the integrity of financial transactions.

- Identity Verification:

The BVN is used to verify an individual's identity during financial transactions. This helps to prevent fraud and ensures that the person conducting the transaction is the rightful account holder.

- Fraud Prevention:

The BVN helps prevent fraud by making it more difficult for fraudsters to impersonate others or create fake identities. This protects individuals from financial losses and other related crimes.

- Security:

The BVN adds an extra layer of security to financial transactions. By providing a unique identifier that is linked to an individual's personal information, the BVN helps to protect against unauthorized access to financial accounts.

- Financial Inclusion:

The BVN promotes financial inclusion by providing a secure and reliable way to verify an individual's identity. This makes it easier for individuals to access financial services, such as bank accounts and loans.

In summary, the "code to check my BVN" plays a vital role in verifying an individual's identity during financial transactions. By providing a secure and reliable way to verify an individual's identity, the BVN helps to prevent fraud, ensure the integrity of financial transactions, and promote financial inclusion.

Online access

The "code to check my BVN" is closely connected to the online accessibility of the BVN through the NIBSS (Nigeria Inter-Bank Settlement System) website. This online access provides several benefits and plays a crucial role in the overall functionality of the BVN system.

- Convenience:

Online access to the BVN lookup service on the NIBSS website offers immense convenience to individuals. They can check their BVN at their own convenience, without having to visit a bank branch or enroll for any special services.

- Efficiency:

The online BVN lookup service is highly efficient. Individuals can obtain their BVN instantly, without having to wait in long queues or go through lengthy processes.

- Security:

The NIBSS website provides a secure platform for individuals to check their BVN. The website utilizes robust security measures to protect users' personal information and prevent unauthorized access.

- Accessibility:

The online BVN lookup service is accessible to individuals with an internet connection and a web browser. This makes it accessible to a wide range of individuals, including those in remote areas or with limited mobility.

In summary, the online accessibility of the BVN through the NIBSS website provides convenience, efficiency, security, and accessibility to individuals. It complements the overall functionality of the "code to check my BVN" by providing an alternative and convenient method for individuals to retrieve their BVN.

Bank branches

The connection between "Bank branches: Individuals can also visit their bank branches to check their BVN." and "code to check my bvn" lies in the alternative method it provides for individuals to retrieve their BVN. While the online BVN lookup service offers convenience and accessibility, visiting a bank branch provides a personal and assisted approach to checking one's BVN.

- In-person Assistance:

Visiting a bank branch allows individuals to interact with bank staff who can provide personalized assistance in checking their BVN. This is particularly beneficial for individuals who may encounter difficulties accessing the online BVN lookup service or who prefer face-to-face interactions.

- Immediate Verification:

Checking one's BVN at a bank branch offers immediate verification. Once the necessary identification documents are provided, bank staff can promptly retrieve the BVN and provide confirmation to the individual.

- Identity Verification:

Bank branches have strict identity verification procedures in place. When checking one's BVN at a bank branch, individuals are required to present valid identification documents. This helps prevent unauthorized access to BVN information and ensures the security of individuals' personal data.

- Additional Services:

Visiting a bank branch to check one's BVN also provides an opportunity for individuals to access other banking services. They can inquire about account balances, make deposits or withdrawals, or seek financial advice from bank staff.

In summary, the ability to check one's BVN at bank branches complements the online BVN lookup service, offering individuals an alternative and assisted method to retrieve their BVN. It provides in-person assistance, immediate verification, enhanced security, and access to additional banking services.

Mobile banking

The connection between "Mobile banking: Checking BVN is possible via mobile banking by dialing 5650#." and "code to check my bvn" lies in the provision of an alternative and convenient method for individuals to retrieve their BVN. While the online BVN lookup service and bank branches offer their respective advantages, mobile banking provides a simple, accessible, and real-time solution for checking one's BVN.

By dialing 5650# on a mobile phone linked to their bank account, individuals can instantly receive their BVN via SMS. This method eliminates the need for internet access or visiting a bank branch, making it particularly useful for individuals in remote areas or with limited mobility. The simplicity of the process also reduces the risk of errors or delays in obtaining one's BVN.

The practical significance of this connection lies in its contribution to financial inclusion and empowerment. Mobile banking has become increasingly prevalent, with a significant portion of the population relying on mobile devices for financial transactions. By integrating BVN checking into mobile banking services, individuals can conveniently and securely access their BVN, enabling them to participate fully in the financial system.

In summary, the connection between "Mobile banking: Checking BVN is possible via mobile banking by dialing 5650#." and "code to check my bvn" underscores the importance of providing multiple channels for individuals to access their BVN. Mobile banking complements the online and bank branch methods, offering a convenient, accessible, and real-time solution that promotes financial inclusion and empowerment.

FAQs on "Code to Check My BVN"

This section addresses frequently asked questions regarding the "code to check my BVN." It aims to provide clear and informative answers to common concerns and misconceptions.

Question 1: What is the purpose of the "code to check my BVN"?

Answer: The "code to check my BVN" refers to the unique identifier assigned to individuals by the Nigerian government for financial transactions and identity verification. It plays a crucial role in preventing fraud, ensuring the security of financial information, and promoting financial inclusion.

Question 2: How can I check my BVN?

Answer: You can check your BVN through multiple methods:

- Dial 5650# on your mobile phone linked to your bank account.

- Visit your bank branch with a valid means of identification.

- Use the BVN Lookup service on the Nigeria Inter-Bank Settlement System (NIBSS) website.

Question 3: Is it safe to share my BVN with others?

Answer: No, it is not advisable to share your BVN with unauthorized individuals. The BVN is a sensitive piece of information that should be kept confidential to prevent fraud and protect your financial data.

Question 4: What should I do if I have lost my BVN?

Answer: If you have lost your BVN, you can visit any branch of your bank or contact the NIBSS customer care line to retrieve it.

Question 5: Is there a fee for checking my BVN?

Answer: No, there is no charge for checking your BVN using any of the available methods.

Question 6: What are the benefits of having a BVN?

Answer: Possessing a BVN offers several benefits, including secure access to financial services, prevention of identity theft, and promotion of financial inclusion.

These FAQs provide essential information on the "code to check my BVN" and aim to clarify any doubts or misconceptions.

Tips on Using "Code to Check My BVN"

To effectively utilize the "code to check my BVN," consider the following tips:

Tip 1: Safeguard Your BVN

Treat your BVN like a confidential password. Avoid disclosing it to unauthorized individuals or websites, as it provides access to your financial information.

Tip 2: Utilize Multiple Channels

You can check your BVN through various channels, including mobile banking, bank branches, and the NIBSS website. Choose the method that is most convenient and accessible to you.

Tip 3: Keep Your Information Updated

Ensure that your personal information linked to your BVN is up-to-date. This includes your address, phone number, and email address. Regularly review and update this information to prevent any discrepancies.

Tip 4: Monitor Transactions Regularly

Keep track of your financial transactions to identify any unauthorized activities. If you notice any suspicious transactions, promptly report them to your bank.

Tip 5: Report Lost or Stolen BVN

In case your BVN is lost or stolen, immediately notify your bank or the NIBSS. Take necessary steps to protect your financial information and prevent fraudulent activities.

Summary

By following these tips, you can effectively utilize the "code to check my BVN" to safeguard your financial data, prevent fraud, and enjoy the benefits of financial inclusion.

Conclusion

The "code to check my BVN" plays a crucial role in promoting financial inclusion, ensuring the security of financial transactions, and preventing fraudulent activities in Nigeria. By understanding the importance of the BVN, individuals can effectively manage their financial information and protect themselves against financial crimes.

It is essential to keep your BVN confidential, utilize multiple channels for checking your BVN, keep your information updated, monitor transactions regularly, and report lost or stolen BVN promptly. By adhering to these practices, individuals can harness the benefits of the BVN system and contribute to a more secure and inclusive financial landscape in Nigeria.

Jaclyn Glenn Feet

Best Thing Ever Happened To Me Quotes

Famous Jacks In Movies